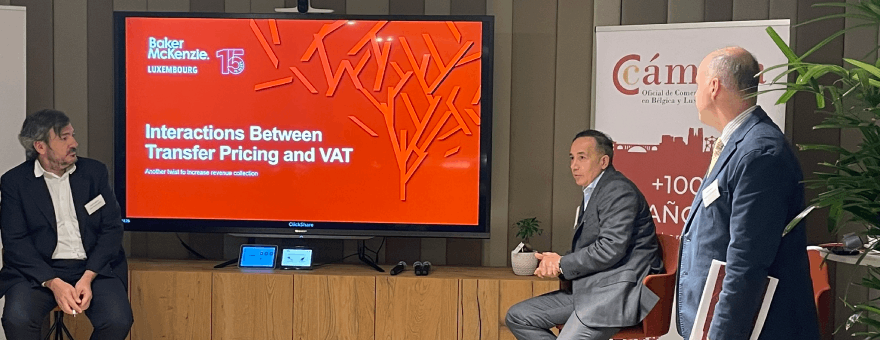

The Chamber organizes with Baker McKenzie the conference in Luxembourg about “Interactions between transfer pricing and VAT: another twist to increase revenue collection”

On 5 November 2025, the Official Spanish Chamber of Commerce in Belgium and Luxembourg, in collaboration with Baker McKenzie Luxembourg, organized a conference about “Interactions between transfer pricing and VAT: another twist to increase”.

Transactions between head offices and their branches are once again in the spotlight of European tax agencies, especially in the areas of VAT and transfer pricing. Growing litigation before the Court of Justice of the EU (CJEU) reflects the challenges companies face in complying with ever more stringent and evolving rules.

In this context, the practical seminar was led by:

- Antonio Weffer, Transfer Pricing Partner, Baker McKenzie Luxembourg.

- Antonio Merino, Lawyer in charge of the VAT practice, Baker McKenzie Luxembourg.

- Antonio Albarran, VAT lawyer, Baker McKenzie Madrid.

The speakers deciphered the latest jurisprudential trends of the CJEU, the transfer pricing documentation requirements and the best practices to optimise the tax burden of your business group. The conference represented a unique opportunity to resolve doubts and anticipate current and future regulatory challenges.

In collaboration with: