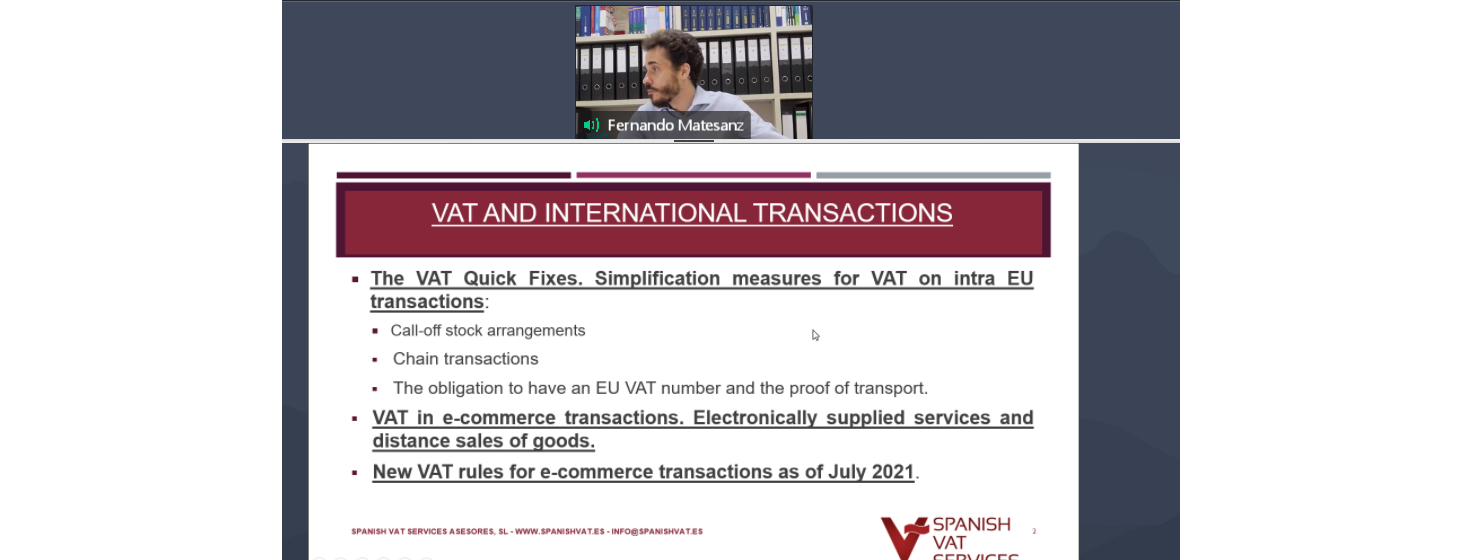

Webinar on “VAT and international transactions”

On July 2nd, the Spanish Official Chamber of Commerce in Belgium and Luxembourg, organized a webinar on “VAT and international transactions” in collaboration with its member company Spanish Vat Services.

The speaker, Fernando Matesanz, Managing Director of Spanish VAT Services, explained the new regulations of the European Directive on the tax aspects of intracommunity operations, emphasizing the implications that these have in relation to VAT, citing among others; call off stocks, chain transactions or the importance of VAT identification. He then explained the recent legislation proposed by the European Commission and their main developments, in order to facilitate and harmonize the rules applicable to the taxation of VAT in e-commerce, as well as its current status and future measures applicable to digital platforms from next year 2021.

At the end, a Q&A round was held in which the participants were able to raise their doubts about the information presented.

From the Spanish Official Chamber of Commerce in Belgium and Luxembourg, we would like to thank Fernando Matesanz for his presentation and dedication, as well as the participants for their presence.

In collaboration with: